On the surface, it probably seems like billing is fairly difficult to get wrong: You send out bills, customers pay them, your business thrives. Of course, it’s not always that simple — customers pay late, or not at all — but on the whole, it would appear that the billing process itself is unlikely to cost your company money.

On the surface, it probably seems like billing is fairly difficult to get wrong: You send out bills, customers pay them, your business thrives. Of course, it’s not always that simple — customers pay late, or not at all — but on the whole, it would appear that the billing process itself is unlikely to cost your company money.

Except that for many businesses, billing actually does cut into revenues. Usually, this stems from simple mistakes that can easily be rectified. If your company is making any of these mistakes, a few small changes can actually improve your billing process and increase profits.

1. Not Paying Attention to Credit Card Fees

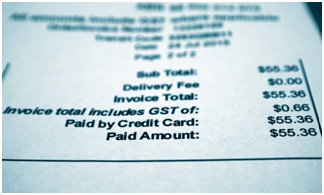

Offering customers the option of paying with a credit card improves customer satisfaction (customers appreciate the convenience) and increases the chances of you actually getting paid on time. However, as you’re probably aware, every time a customer uses plastic to pay a bill, you incur processing fees. These fees can add up quickly, and on small transactions, the fees can actually eat up your revenue.

The solution, then, is to place stipulations on the amount of credit card transactions and the number of transactions a customer can make in a defined period. In other words, don’t allow customers to make 20 $5 payments on a $100 bill, unless you want to lose as much as 3 percent on each transaction. It sounds crazy, but disgruntled customers have been known to pay bills that way as a protest, so protect yourself. If you want to continue offering the option of a credit card payment for every transaction, regardless of amount, consider adding a processing fee to cover your costs.

2. Not Using Proper Etiquette

When you send your bills, how do you request payment? Studies show that using your manners— saying “please” and “thank you” on bills increases the number of on-time payments by 5 percent. If your bills aren’t polite, fix that right away.

3. Not Charging for Late Payments

No likes paying bills. They really don’t like paying more than they have to. Adding a late charge or interest to unpaid bills creates a sense of urgency and an incentive to pay bills on time. Be clear with your customers about how much you will charge and when, and follow through. Remember: Unpaid bills cut into your revenue, and can affect the operation of your business. Don’t be afraid to seek reimbursement for that inconvenience.

At the same time, you can increase on-time payments and increase customer satisfaction by offering incentives for paying before the due date. Discounts and credits are always appreciated, and will improve your on-time payment rates.

4. Not Offering Different Payment Options

Offering a variety of payment options also increases the likelihood of on-time payments. Customers like to have choices, so allowing them to pay by check, credit card, or other means will encourage them to pay on time. Work with a company that provides payment processing solutions to streamline your billing and automatically provide multiple options to customers. As a bonus, such solutions will help streamline your billing, by sending invoices, processing payments, and keeping track of what’s outstanding and what’s been paid.

Offering a variety of payment options also increases the likelihood of on-time payments. Customers like to have choices, so allowing them to pay by check, credit card, or other means will encourage them to pay on time. Work with a company that provides payment processing solutions to streamline your billing and automatically provide multiple options to customers. As a bonus, such solutions will help streamline your billing, by sending invoices, processing payments, and keeping track of what’s outstanding and what’s been paid.

5. Mailing Bills

Do you automatically mail invoices and statements to customers? If so, you are probably spending far more than necessary on paper and postage. On average, it costs at least 60 cents per bill to send it in the mail, including the paper, ink, envelope, and postage. With postal rates increasing all the time, those costs will only continue to go up — and that’s not even considering the time it takes for staff to stuff envelopes, or the costs of paying a mailing service to do it for you.

The cost of mailing bills is even more frustrating when you consider that the majority of people end up paying their bills online anyway, even when they receive them in the mail. Studies show that at least two thirds of people pay at least one bill online every month, with most paying all of their bills online. While setting up an electronic billing and payment system isn’t free, if the majority of your customers pay online, you can all but eliminate mailing costs, and in time, reduce your billing overhead. There will probably always be customers who prefer a printed invoice, but reaching the majority of customers electronically will save you money.

Many entrepreneurs consider billing just another cost of doing business, but that doesn’t mean you have to pay more than you need to. By fixing these issues, you’ll not only reduce billing costs, but increase your on-time payment rate and keep customers happy, which can only help your business.

Comments